Hosted by

Carl Seidman CPA | Microsoft MVP

The person Fortune 500s use for their financial leadership development programs

4.9 (27 Ratings) · 5 Weeks · Cohort-based Course

Hosted by

Carl Seidman CPA | Microsoft MVP

Partial List of Current & Former Clients

Course Overview

In this exceptionally interactive, roll-up-your-sleeves program, you will transition from a traditional financial analyst to a strategic financial modeler and advisor, capable of building complex and dynamic integrated Excel models that capture the intricacies of business operations.

WHY THIS COURSE:

In this practical, examples- and discussion-heavy course, you will learn & apply the principles that experienced management consultants and FP&A leaders use in financial and operational business modeling. This experience will walk you through the step-by-step methods for data acquisition, model structuring, and building integrated 3-statement financial and operating models. It focuses on modeling for performing and underperforming businesses, not investment banking transactions.

SHOULD I JOIN THIS COURSE:

Whether you are a financial analyst, Controller, Director of FP&A, or CFO, you will build greater confidence and critical thinking skills. While other financial modeling training mostly focuses on model-building, how financial statements connect, and plugging in numbers from super-clean data, this program will walk you through real-life scenarios and the strategic financial considerations you’ll be making in your work.

This is not a foundational course. And despite the title, it does not require advanced skills — it requires advanced, higher-level thinking. The people who enroll tend to have a decent amount of professional experience. Despite this, there is no specific level cutoff and anyone, from any background, will get a ton out of it.

Because the program is live and cohort-based, it provides a hands-on and immersive experience with a 20-year finance practitioner and a group of smart, driven professionals just like you.

The modeling techniques learned are the same techniques and methods employed in small entrepreneurial businesses, mid-market companies, and Fortune 1000s.

The ability to build powerful financial models is no longer just for investment bankers and Excel gurus. It’s a necessity for corporate finance and FP&A professionals too.

WHY LEARN FROM CARL:

Carl was originally engaged by one of the leading management consulting firms in the U.S. to design and develop a business modeling curriculum for experienced advisors. He understood that the program would be invaluable for financial professionals of all types, including turnaround and restructuring consultants, FP&A advisors, CFOs, private equity analysts, and accountants.

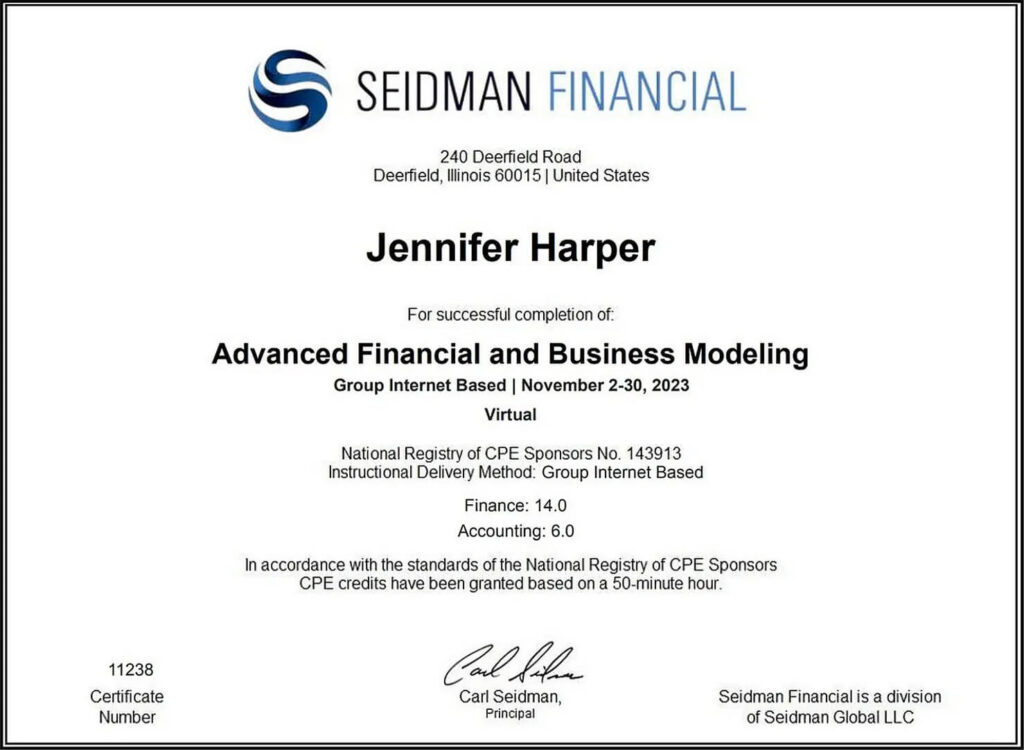

Seidman Financial is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit. Complaints regarding registered sponsors may be submitted to the National Registry of CPE Sponsors through its website: www.NASBARegistry.org.

Seidman Financial is a division of Seidman Global LLC.

2025 COHORTS:

Tue 7/8 9:00 AM—11:00 AM (CDT)

📄 Introduction to 3-Statement Financial Modeling and Integrated Business Modeling

📄 3-Statement Financial Modeling (Corporate Finance vs. Investment Banking)

📄 Context is Key: Understanding Business/Client Objectives

📄 Understanding the Dynamics of the Business and its Industry

📄 🎯 INTRODUCTION TO THE BUSINESS CASE

📄 Modeling Skills Inventory: The Skills you Need and Those You Don’t

Fri 7/11 9:00 AM—11:00 AM (CDT)

📄 Introduction to 3-Statement Financial Modeling and Integrated Business Modeling

📄 3-Statement Financial Modeling (Corporate Finance vs. Investment Banking)

📄 Context is Key: Understanding Business/Client Objectives

📄 Understanding the Dynamics of the Business and its Industry

📄 🎯 INTRODUCTION TO THE BUSINESS CASE

📄 Modeling Skills Inventory: The Skills you Need and Those You Don’t

Tue 7/15 9:00 AM—11:00 AM (CDT)

📄 Designing and Developing the Model at the Outset of the Project

📄 Model Formats and Layouts: Vertical Structure vs. Horizontal Structure

📄 Model Hygiene and Common Font Color Schemes

📄 Other Modeling Best Practices to Consider

📄 Error Check Schedules and Conducting Quality Reviews

Fri 7/18 9:00 AM—11:00 AM (CDT)

📄 Overview of the Financial Statements

📄 The Income Statement

📄 The Balance Sheet

📄 The Statement of Cash Flows – Indirect

📄 The Statement of Cash Flows – Direct

📄 Understanding the Key Connection Across the Financial Statements

📄 Accrual vs. Cash Impact

📄 Identifying Risks and Uncertainty Inherent in the Business and Model

📄 Overview of the Integrated Financial Statement Modeling Process

Tue 7/22 9:00 AM—11:00 AM (CDT)

📄 Overview of the Income Statement | Profit & Loss

📄 Review of the Historical Financials and What They Mean for the Forecast Model

📄 Identifying Revenue Drivers and Segmenting the Sales Forecast

📄 Driver-Based Forecasting: Industry Examples

✍️ Exercise: Forecasting Revenue (Submit by Aug 20)

📄 Identifying Cost Types and Drivers | Forecasting Direct Costs

✍️ Exercise: Forecasting Direct Costs (Submit by Aug 20)

📄 Forecasting General Overhead Expenses (SG&A)

✍️ Exercise: Forecasting Key SG&A Line Items (Submit by Aug 20)

Fri 7/15 9:00 AM—11:00 AM (CDT)

📄 Overview of the Balance Sheet

📄 Key Balance Sheet Roll-Forwards

📄 Accounts Receivable (A/R) Roll-Forward

📄 Days Sales Outstanding (DSO) and A/R Aging Analysis

✍️ Exercise: Accounts Receivable Roll-Forward (Submit by Aug 20)

📄 Inventory Roll-Forward

📄 Days Inventory Outstanding (DIO) | Days Inventory On Hand (DOH) Analysis

✍️ Exercise: Inventory Roll-Forward (Submit by Aug 20)

📄 Prepaid Expense Roll-Forward

📄 Accrued Payroll Roll-Forward

✍️ Exercise: Accrued Payroll Roll-Forward (Submit by Aug 20)

📄 Accrued Professional Expenses and Fees Roll-Forward

✍️ Exercise: Accrued Professional Fees Roll-Forward (Submit by Aug 20)

📄 Taxes Payable Roll-Forward

✍️ Exercise: Taxes Roll-Forward (Submit by Aug 20)

📄 Accounts Payable | Accrued Expenses Roll-Forward

📄 Days Payable Outstanding (DPO) Analysis

✍️ Exercise: A/P and Accrued Expenses Roll-Forward (Submit by Aug 20)

📄 Review of the Key Working Capital (WC) Accounts and Roll-Forwards

📄 Capital Expenditures (CapEx) and Fixed Assets Roll-Forward

📄 Intangible Assets Roll-Forward

✍️ Exercise: Fixed Assets and Intangible Assets Roll-Forward (Submit by Aug 20)

📄 Long-Term Debt Roll-Forward

✍️ Exercise: Long-Term Debt Roll-Forward (Submit by Aug 20)

Tue 7/29 9:00 AM—11:00 AM (CDT)

📄 Revisiting the 3-Statement Modeling Process

📄 Building the Statement of Cash Flows

✍️ Exercise: Building the Statement of Cash Flows (Submit by Aug 20)

Fri 8/1 9:00 AM—11:00 AM (CDT)

📄 Connecting the Financial Statements

📄 Modeling Plugs and Unknowns — Revolving Lines of Credit, Cash, Accrued Expenses

✍️ Exercise: Revolving Line of Credit Roll-Forward Submit by Aug 8

📄 Interest Expense Roll-Forward

✍️ Exercise: Interest Expense Roll-Forward Submit by Aug 8

📄 Completing the Integrated Financial and Business Model

Tue 8/5 9:00 AM—11:00 AM (CDT)

📄 Revisiting the 3-Statement Modeling Process

📄 Performing Quality Review and Error-Checks

📄 Limitations of the Financial Model

📄 Developing a Recurring Process for Updating the Model

Fri 8/8 9:00 AM—11:00 AM (CDT)

📄 Advanced Concepts in Integrated Financial and Business Modeling

📄 Borrowing Base Roll-Forward

✍️ Exercise: Borrowing Base Roll-Forward (Submit by Aug 20)

📄 The EBITDA-to-Cash Bridge: Reconciling Profitability with Liquidity

✍️ Exercise: EBITDA-to-Cash Bridge (Submit by Aug 20)

📄 Explaining Hits and Misses: Illustrating With Variances and Waterfalls

📄 Organizing the Model for Presentations

📄 Updating Operating Assumptions and Running Business Scenarios

✍️ Exercise: Actively Manage Costs and Expenses (Submit by Aug 20)

📄 Summary and Final Thoughts

✍️ Capstone Business Case: Advanced Financial and Business Modeling Submit by Aug 15

Tue 8/12 9:00 AM—10:00 AM (CDT)

📄 LinkedIn Learning Courses by Carl Seidman

Carl serves as a Fractional CFO, FP&A advisor, and management consultant to entrepreneurial businesses throughout North America and Europe and assists them with strategic financial planning, value enhancement, and revitalization.

He is a Microsoft MVP and one of the preeminent trainers and facilitators in strategic finance and FP&A, with more than 13,000 participants attending his financial training programs, seminars, workshops, and masterminds. Notable clients include:

ABM Industries, Accordion, AlixPartners, Allscripts, Broadridge, CHEP, Choice Hotels, CIBC, Cigna, Cox Enterprises, Crawford & Company, Deloitte, Dexcom, Discover, Dominium, Express Scripts, EY, FS Investments, EVRAZ, Genentech, Healthpeak, Heartland Financial, Hewlett Packard Enterprise, Hostess, IGT, KPMG, Marsh & McLennan, Michelin, NerdWallet, Radisson, Rapid7, Sol Petroleum, Spotify, Triple-S, Telus, Santander, United Technologies (RTX), UBT, Verizon, Walmart, and Workday.

Carl is masterful at making the complex amazingly simple, engaging his audiences, building confidence, and facilitating a welcoming and transformative group experience. His content is rich and relatable, used in financial leadership development programs (FLDPs) at Fortune 500 companies, and is utilized or licensed by 7 of the top global financial training companies.

Carl serves as an Adjunct Professor in data analytics at the Jones School of Business at Rice University. He is a Certified Public Accountant (CPA) has earned other professional credentials including the CIRA, CFF, CFE, CGMA, AM (Accredited Member in Business Valuation), CSP (Certified Speaking Professional), Certified Anaplan Model Builder, and was a National Association of Certified Valuators and Analysts (NACVA) 40 Under Forty honoree. He holds a BA in finance and economics and an MS in managerial accounting.

He’s been where you want to be and does the work you want to do.

Contact: info@seidmanfinancial.com

You are strongly encouraged not to miss live sessions, as a great part of the experience is both the live-reveals and the participant interaction.

In other words, you get to:

Yes, sessions are recorded and you can go through them on your own, but learning may be more limited.

We meet for 5 weeks, 4 hours each session. It is intentionally spaced out over a number of days and weeks so you can work your schedule around it.

That’s 20 hours all in: content, discussion, reflection, cases, and Q&A.

There is occasional pre-work and post-session work but it is minimal.

It is not customary for me to offer refunds. Across hundreds of training, seminars, workshops, and conferences — in person and virtual — to thousands of people, I have never been asked once for a refund.

For one in-person training program, there was a blizzard and my flight was canceled. I offered a rescheduling option for a future date.

I offer more than a dozen training programs and immersive development experiences across a wide range of finance and accounting topics.

Here are the other programs I offer.

This program is designed for professionals who want to hone their skills in 3-statement financial, operations modeling and forecasting.

We meet live on Zoom.

Each session consists one or more modules. Each module ties into prior and future modules, so it is vital to try to avoid missing classes.

Sessions begin with an intro, a tie-in to a real example, exercises, discussion, and reflections.

There are lessons where you will be expected to complete them on your own.

Prerequisites for the course include the following:

Yes, it qualifies for 20.0 CPE credits.

Seidman Financial is registered with the National Association of State Boards of Accountancy (NASBA) as a sponsor of continuing professional education on the National Registry of CPE Sponsors. State boards of accountancy have final authority on the acceptance of individual courses for CPE credit.

Yes. You get all of the template models, clean and completed. You get access to my FP&A and CFO community.

Most on-demand courses teach steps for plugging numbers into templated models. They don’t teach the nuances that you’re likely to encounter across a wide range of instances. Advanced financial modeling trainers tend to not come from FP&A and restructuring backgrounds.

According to alumni, this is the best financial modeling course available.